Traders’s Profile – Georgia

Location, Size & Sectors

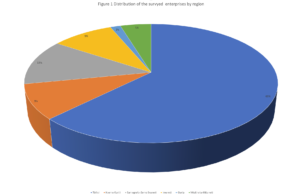

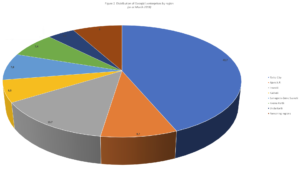

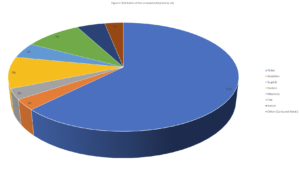

In-depth interviews were carried out with a representative sample of 65 traders, who represented small and medium enterprises (SMEs) and belonged to the strategic non-resource sectors . Around 63 per cent of the surveyed enterprises are in the region of Tbilisi (Figure 1). The region of Samegrelo-Zemo Svaneti is home for the second largest segment followed by the regions of Kvemo Kartli and Imereti, mirroring the country wide spatial distribution of enterprises (Figure 2). The enterprises are concentrated in the country’s major industrial hubs, including the capital city of Tbilisi, Rustavi, the port city Poti and Kutaisi (Figure3), and operate from industrial estates (57 per cent of the enterprise) and commercial areas (53 per cent).

The surveyed enterprises are dominated by small enterprises, employing between 10 and 49 persons. These constituted the largest segment (45 per cent), followed by medium enterprises employing between 50 and 249 persons (25 per cent). Micro enterprises employing fewer than 10 persons represent the third largest segment (17 per cent), with large enterprises (employing 250 persons and above) accounting for the remaining 14 per cent. 1 [1]

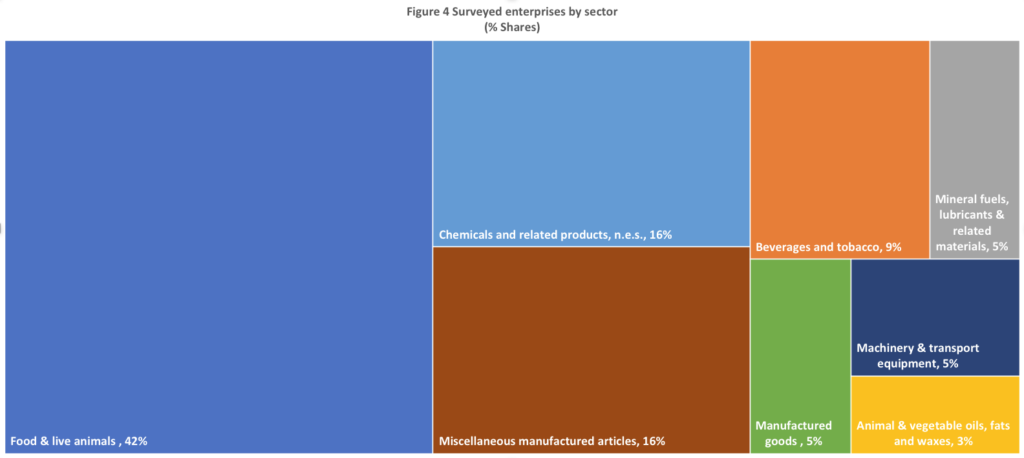

Most of the enterprises belong to agriculture. As shown in figure 4, agri-industry represents 42 per cent of the surveyed enterprises, followed by those engaged in the production of miscellaneous manufactured goods (10 per cent) and chemical products (10 per cent).

Moreover, around 92 per cent are engaged in production activities. The enterprises manufacture 74 products, including 71 final and 3 semi-final products. These are produced using both domestic and sourced raw materials, with 58 per cent of the enterprises reporting heavy involvement in import activities. The enterprises sell these products (along with some of the imported goods) in domestic and global markets, with 82 per cent reporting a consistent involvement in export activities.

[1] The classification of SMEs follows the EU Commission Recommendation 2003/361/EC “Concerning the Definition of Micro, Small and Medium-sized Enterprises”.

Exports and target markets

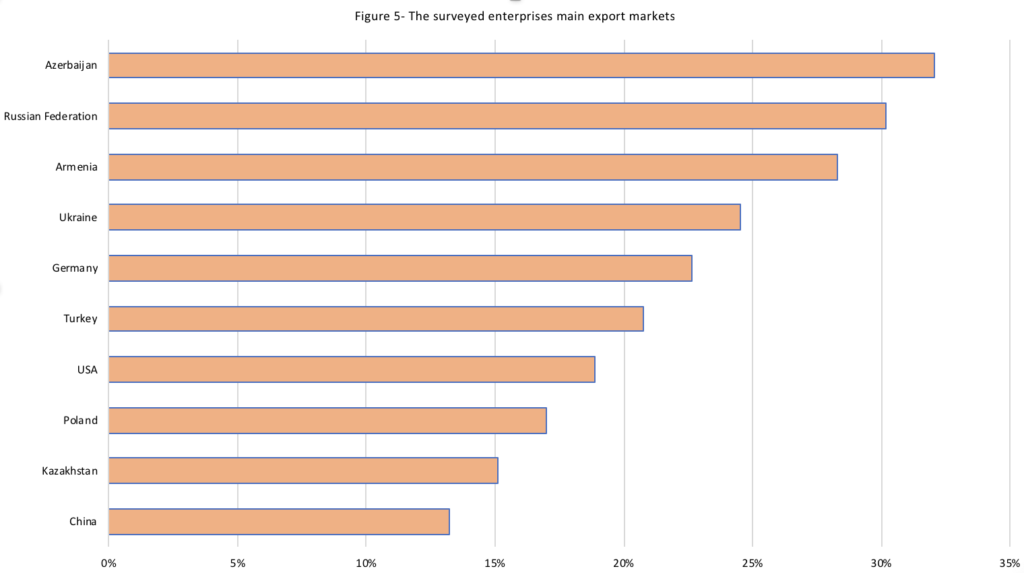

The surveyed enterprises export 63 products, the bulk of which is sold in Republic of Azerbaijan (Figure5). This overall pattern masks differences at the sectoral level, with exporters of beer, hazelnuts, lemonade, medicinal herbs, wine and water showing the most diversified export markets.

Enterprises engaged in the production of sandwich panels, steel pipelines and organic fertilizers seem to be the least successful in establishing themselves abroad, with their products sold in one market only.

DOCUMENT

Supply Sources

The enterprises source 70 products. Turkey supplies around 53 per cent of these products, followed by China (32 per cent) and the Russian Federation (29 per cent).

Transport mode

Trucks stand out as the transport mode of choice for the surveyed business enterprises, which are sometimes used in combination with sea transport depending on the destination country (Figure 7). Maritime transport was singled out as the sole mode of transport for goods destined to Belgium, China, Japan, Ukraine and the United States (US) or for importing goods from India, Belgium, Jamaica, Netherlands and the US.

Rail does not figure among the traders’ transport modes of choice. It is mainly used for shipping goods destined to/ imported from/ transiting through Armenia, the Republic of Republic of Azerbaijan as well as Central Asia, and is sometimes used for transporting goods destined to/imported from China.[1]Similarly, transport by air is used for shipping small packages (often for emergency shipments).

[1] Georgia’s railway network serves as a transit to Armenia, Republic of Azerbaijan and Central Asia.